nh meals tax form

If prepared by a person other than the operator this declaration is based. Select the document you want to sign and click Upload.

Facilities Campground Crow S Nest Lake Sunapee

There are three variants.

. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. 2 months after notice of tax. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax.

Low Income Housing Tax Credit. EFiling is easier faster and safer than filling out paper tax forms. If you have questions call 603 230-5920.

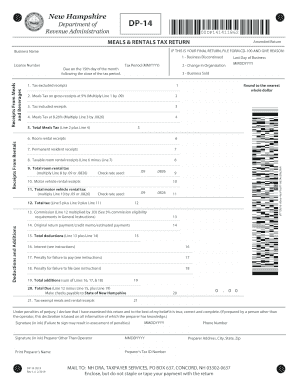

TOTAL TAX DUE - The total of lines 11 and 12 is the total tax due to the State of NH. A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. Create your eSignature and click Ok.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. 8 months after notice of tax. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

File your New Hampshire and Federal tax returns online with TurboTax in minutes. Rentals Tax and follow the prompts. There is also a 85 tax on car rentals.

A typed drawn or uploaded signature. Exact tax amount may vary for different items. Ss by 2504 eff 10-12-83.

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. More about the New Hampshire DP-14 Bklt. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

Real Estate Transfer Tax. Tax Excluded Receipts Meals Tax 8 Line 1 multiplied by 08 Meals Tax 741 Line 3 multiplied by 0741 TOTAL MEALS TAX Line 2 plus Line 4 RECEIPTS FROM RENTALS Motor Vehicle Rental Receipts TOTAL TAX Line 5 plus Line 9 plus Line 11 Permanent Resident Receipts Room Rental Receipts Check rate used. NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION MEALS RENTALS TAX RETURN.

If your municipalitys final tax bill was sent out after December 31 as determined by the BTLA the above deadlines are modified as follows RSA 761-a. We will update this page with a new version of the form for 2023 as soon as it is made available by the New Hampshire government. 6 months after notice of tax.

Meals And Rooms rentals Tax - Nh Department Of Revenue Mak86w - Waterfront Vacation Rental With Indoor Pool The State Of New Hampshire Judicial Branch. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the. Save Time Editing Documents.

A Rindge New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. INTEREST ON TAX DUE - Interest is due on the tax if not paid in a timely manner. MEALS RENTALS TAX RETURN Instructions Meals Rental Operators may file electronically on the Departments website at wwwrevenuenhgovgtc.

Fast Easy Secure. FREE for simple. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters.

Ad Robust web-based PDF editing solution for businesses of all sizes. Decide on what kind of eSignature to create. This form is for income earned in tax year 2021 with tax returns due in April 2022.

There are however several specific taxes levied on particular services or products. We last updated New Hampshire DP-14 Bklt in April 2022 from the New Hampshire Department of Revenue Administration. Follow the step-by-step instructions below to eSign your nh dp14.

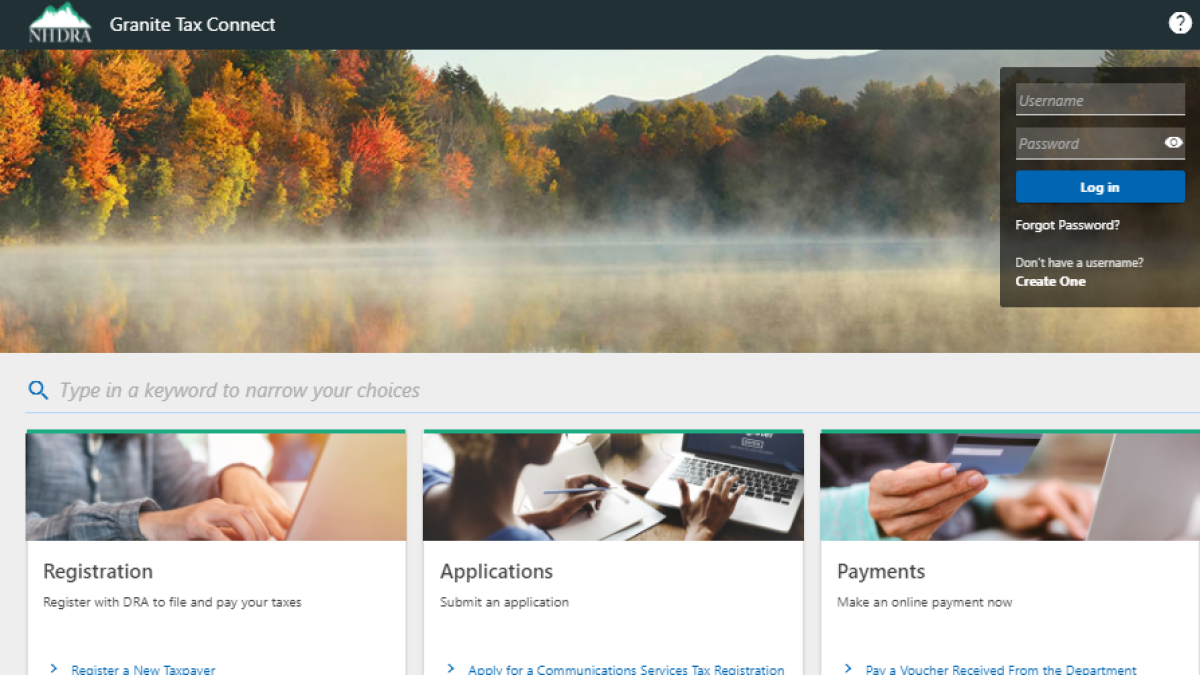

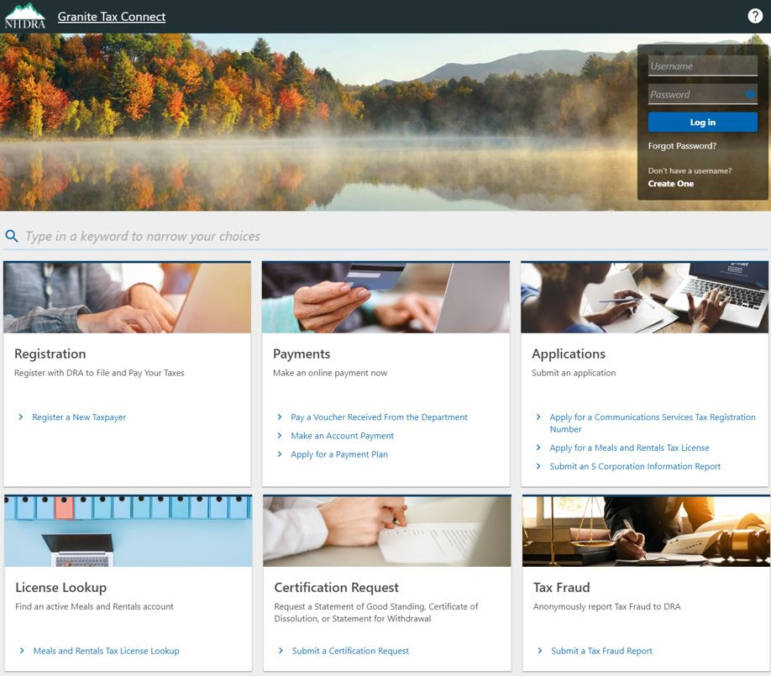

Please visit GRANITE TAX CONNECT to create or access your existing account. Line 8 multiplied by 08 or 0741 if tax included. File this form at least 30-days prior to the start of business or the expiration date of the existing license.

2 NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION MEALS RENTALS TAX BOOKLET GENERAL INFORMATION MR General Info Rev 122015 FORM MR General Information MR TAX LICENSE REQUIREMENT The MR Tax is a tax assessed upon patrons of hotels restaurants and renters of motor vehicles based on the. CHAPTER Rev 700 MEALS AND RENTALS TAX. PART Rev 701 DEFINITIONS.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022. Be sure to visit our website at revenuenhgovGTC to create your account access today.

Tax Returns Payments to be Filed. When this form is needed - You must fill out and file. Lounges or other facilities providing any forms of entertainment.

After that your nh meals and rooms tax form is ready. Download or print the 2021 New Hampshire DP-14 Bklt 2013 Meals and Rentals Booklet for FREE from the New Hampshire Department of Revenue Administration. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Rindge New Hampshire Meals Tax.

File this form at least 30-days prior to the start of business or the expiration date of the existing license. Payment on your FUTA form Line 13. Edit PDF Files on the Go.

PROCESSING DIVISION PO BOX 2035 CONCORD NH 03302-2035 Under penalties of perjury I declare that I have examined this form and to the best of my belief it is true correct and complete. NH DRA PO Box 454 Concord NH 03302-0454. CHECK the AMENDED RETURN box if you are filing to make changes or corrections to a previously filed DP-14 for any ONE taxable period.

Document 6690 effective 2-21-98. NH DRA PO Box 454 Concord NH 03302-0454. WHERE TO FILE Mail to.

Example line 11 X UI Tax Rate 35 49000 line 12 X AC Tax Rate 02 2800 line 13 TOTAL TAX DUE 51800 if under 100 no payment due Line 14. THE STATE OF NEW HAMPSHIRE General Instructions for Completing the Financial Affidavit Form NHJB-2065-F A. The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals.

How to use sales tax exemption certificates in New Hampshire. The MR Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by operators of hotels restaurants or other businesses providing. New Hampshire Department of Revenue Administration.

2022 New Hampshire state sales tax. A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. Timber Gravel Tax.

New Hampshire is one of the few states with no statewide sales tax. The Meals and Rentals MR Tax was enacted in 1967. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

New Hampshire Revenue Dept Launches Final Phase Of Tax System

Function Agreement Restaurant 45 Agreement Function Function Room

New Hampshire Meals And Rooms Tax Rate Cut Begins

New Hampshire Legislation Reduces Corporate Taxes Eliminates Personal Income Tax Albin Randall And Bennett

Usborne Books More Usborne Books Usborne Books

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Us 734514 The Nicholson Bridge Also Called Tunkhannock Viaduct Nicholson Pennsylvania Usa Railroad Photos Railroad Bridge Railroad Art

What Is Cafe 125 On A W 2 Tax Form Turbotax Tax Tips Videos

Get And Sign Nh Dor 2019 2022 Form

2021 22 Irs Per Diem Travel Expenses Updated Windes

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax Money Choices

Nh Dept Of Revenue Administration Launches New Online User Portal For Paying Taxes And More Manchester Ink Link

3 Things You Need To Know About The New Tax Code New Hampshire Public Radio

Used Grumman Step Van Food Truck In Florida For Sale Step Van Custom Bbq Pits Trucks

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes